When it comes to securing wealth and making stable investments, many in the UK turn to gold. But what factors drive the “Gold Price in the UK”? Understanding these fluctuations is crucial for both new and seasoned investors. Gold isn’t just a glittering metal—it’s a barometer of economic stability and a haven during uncertain times. Let’s explore what influences the price of gold, its role in the UK economy, and how you can make informed decisions about investing in this timeless asset.

What Affects Gold Prices in the UK?

Gold prices in the UK are impacted by a complex web of global and local factors. Understanding these variables helps investors grasp when and why gold prices shift and how they can strategically approach their investments.

Gold: A Popular Investment Choice

Why does gold hold such a revered place among investments? Gold is considered a “safe-haven asset” because it generally holds its value, even when other investments dip. In times of economic turbulence, gold’s stability appeals to investors looking to preserve their wealth.

Tracking Gold Prices: Why It Matters in the UK

Monitoring gold prices isn’t just for experts. For any investor in the UK, understanding gold’s movements can offer insights into broader economic trends and guide smarter investment choices. When uncertainty arises, gold often responds positively, helping investors maintain stability in their portfolios.

Key Factors That Influence Gold Prices

| Factor | Explanation |

|---|---|

| Global Market Trends | Worldwide economic changes affect gold prices, with major markets like the US and China having a strong impact. |

| Supply and Demand | When gold supply dips or demand spikes, prices naturally rise. Economic uncertainty often leads to higher demand. |

| Political and Economic Stability | Political events, like elections or global conflicts, influence gold prices, impacting investor confidence. |

| Currency Exchange Rates | Because gold is often priced in US dollars, a weaker British pound can increase the cost of gold for UK buyers. |

A Look at Historical Gold Price Trends in the UK

Gold’s price hasn’t followed a smooth path—it’s been shaped by economic events worldwide. In the last decade, UK gold prices have experienced major swings, particularly during events like Brexit and the COVID-19 pandemic. These periods of uncertainty tend to drive gold prices higher as investors seek a stable store of value.

The Influence of Central Banks on Gold Prices

Central banks, including the Bank of England, hold large reserves of gold, and their decisions can significantly impact global gold prices. When central banks increase their gold reserves, demand rises, often pushing prices up. Conversely, selling off gold reserves can lower prices.

Gold’s Role in the UK Economy

Gold isn’t just an investment tool—it plays a strategic role in the UK’s economy. The Bank of England holds substantial gold reserves, providing a cushion against economic instability and supporting the nation’s financial standing. This influence underscores why gold remains relevant beyond just its investment value.

The Pound and Gold Prices: An Interdependent Relationship

The strength of the British pound is closely tied to the cost of gold in the UK. When the pound weakens relative to the dollar, gold becomes more expensive for UK buyers. This currency relationship means that gold prices often reflect broader economic conditions in the UK.

Spot Price vs. Futures Price: Understanding the Difference

If you’re following gold prices, you’ll likely come across “spot price” and “futures price.” Here’s what they mean:

- Spot Price: This is the current price of gold if you were to buy it immediately.

- Futures Price: This is the price of gold agreed upon today for delivery at a future date, reflecting market expectations.

- Both prices provide valuable insights, but they serve different purposes. Spot prices give a snapshot of current demand, while futures prices can indicate longer-term trends.

Current Gold Price Trends in the UK

Monthly and yearly trends reveal that gold prices are currently on an upward trajectory. With economic uncertainties persisting, gold has maintained its appeal, showing steady growth over time. These trends suggest that gold remains a resilient option for those interested in long-term investments.

How to Invest in Gold in the UK

For UK investors, there are various ways to enter the gold market. Whether you prefer physical gold or are looking for indirect exposure, here’s a breakdown of your options:

| Investment Option | Description |

|---|---|

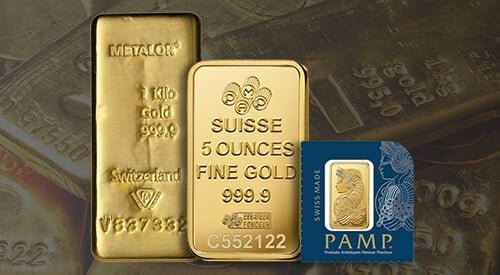

| Physical Gold (Bullion & Coins) | Buying physical gold like bars and coins allows for tangible asset ownership. |

| Gold ETFs & Mutual Funds | Ideal for those who prefer not to handle physical assets; these funds track gold prices. |

| Gold Mining Stocks | Invest in companies that mine gold, indirectly benefiting from gold’s price movements. |

Steps for First-Time Gold Buyers in the UK

If you’re new to gold investing, here are some tips:

- Research Trusted Dealers: Make sure to work with reputable dealers for purchasing physical gold.

- Understand Market Timing: Timing your purchases can help maximize your returns, especially if you’re buying physical gold.

- Diversify Your Portfolio: Consider gold as part of a balanced portfolio to manage risk effectively.

Risks of Investing in Gold

While gold is considered a safe investment, it isn’t without risks. Gold prices can be volatile due to geopolitical factors, market shifts, and sudden changes in demand. It’s essential for investors to remain aware of these risks and avoid over-relying on gold alone.

Future Outlook for Gold Prices in the UK

Financial analysts expect gold prices to continue rising in the near future. Economic challenges globally, paired with currency fluctuations, suggest that gold may hold or increase its value. However, predictions vary, and it’s crucial to stay informed and be prepared for shifts.

Conclusion

Gold has long been a trusted asset, providing stability for investors, especially during uncertain economic times. For UK investors, gold represents not only a way to safeguard wealth but also an opportunity to benefit from price increases in a secure and historically resilient asset. As always, understanding the forces that impact gold prices will help you make the best choices for your financial future.

FAQs

Why does the price of gold change so frequently?

Gold prices are influenced by global demand, economic conditions, and currency fluctuations, leading to frequent changes.

Is buying physical gold better than investing in gold ETFs?

Physical gold provides tangible ownership, while ETFs are easier to trade. It depends on your investment goals and risk tolerance.

How often should I check gold prices as an investor?

For long-term investments, monthly check-ins are usually sufficient, though active traders might monitor daily.

What’s the safest way to store physical gold in the UK?

Options include secure home safes, bank vaults, or specialized storage facilities. Ensuring security is key.

Are gold prices expected to rise in the next few years?

Analysts generally expect an increase due to economic uncertainties, but predictions can vary based on global conditions.